The Complete Guide to Electric Car Charger Costs for Fleets

November 4, 2022

Get Started with Samsara

Check our pricesKey Takeaways

Learn about electric car charger costs, charging networks, and the basics of installing EV chargers for your fleet.

When evaluating electric vehicles (EVs) for your fleet, one of the first considerations is charging—cost, availability, and timing. On average, the cost to charge an electric car is 3.5x less per mile compared to the cost to fuel a gas-powered car. While the cost of charging varies by location and time of day, electricity prices are more stable than gas prices.

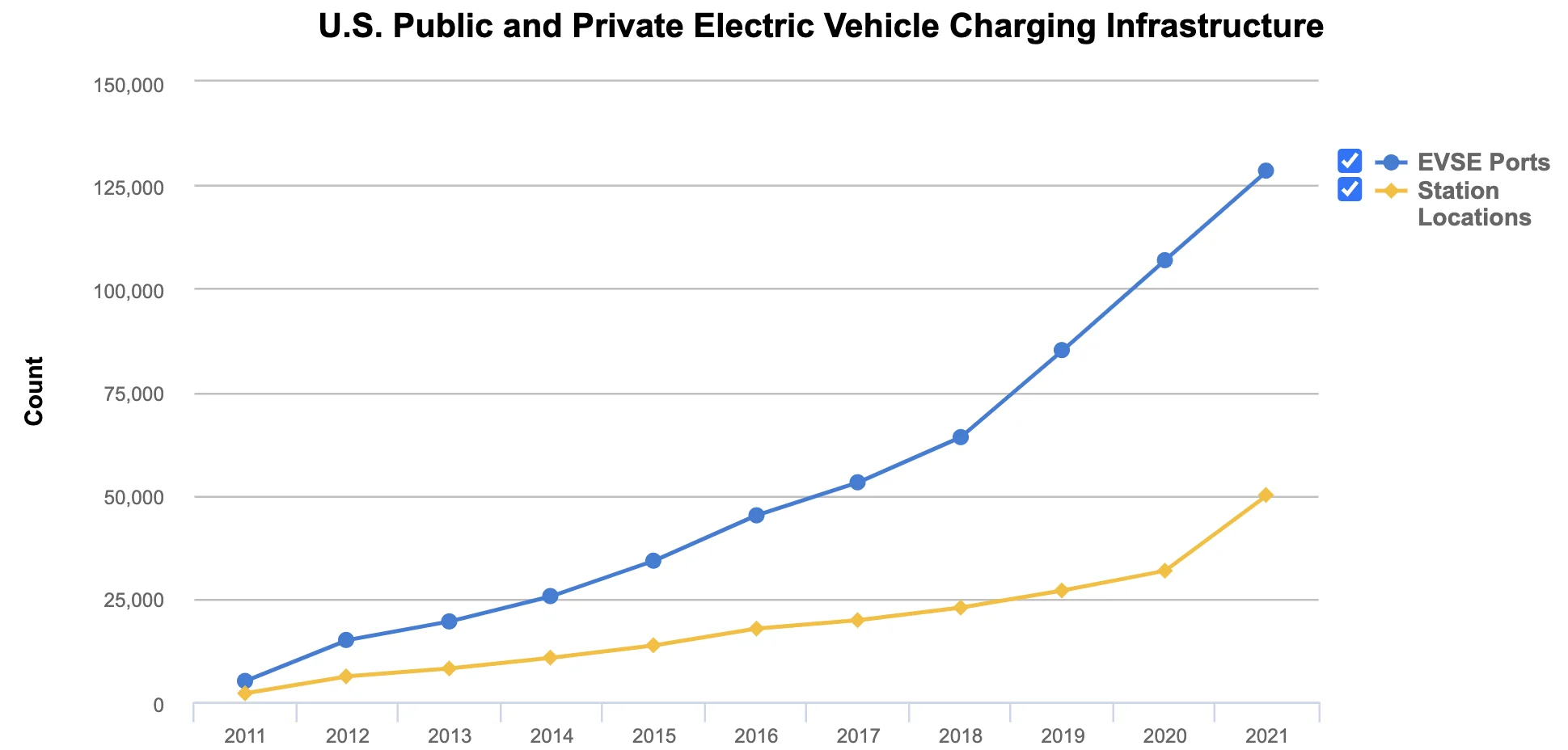

EVs in a fleet can choose whether to use public or private charging networks. The U.S. public EV charging network has approximately 47,000 level 2 and DC fast chargers combined—about 6,500 of those are DC fast chargers, found on this interactive map. Both public and private charger quantities are rapidly growing—from 2015 to 2020, the number of charging stations grew by over 100%, and in 2021 alone the total amount of charging stations increased by 55%.

All-electric, battery-powered vehicles (BEVs) and plug-in hybrid vehicles (PHEVs) both use EV chargers but have different charging times as PHEVs have smaller batteries and thus, faster charging times. This guide will focus on the basics of EV charging based on charger type, location, and time of use.

Types of electric vehicle chargers

There are three types of EV chargers—Level 1, 2, and 3— that use two types of power: Alternating Current (AC) and Direct Current (DC). The main difference between AC and DC power is charging speed.

EV batteries only accept DC power—Level 1 and 2 chargers distribute AC power, so the conversion to DC power occurs inside the EV battery, leading to slower charging times. Level 3, or DC fast chargers, convert AC to DC power inside the charging station, not the vehicle’s battery, for the fastest charging times.

Charger Type

Power

Charge Time

Summary

Level 1

120-volt

40+ hours to charge BEV from empty

AC power; slowest charger; standard for home charging

Level 2

240-volt

4-10 hours to charge BEV from empty

AC power; most commonly found at commercial or public charging stations

Level 3

480-volt minimum

20-60 minutes to charge BEV from empty

DC power; also known as DC fast chargers, DCFC, or superchargers; needed for MHD vehicle charging

How to calculate electric vehicle charging costs

Several factors contribute to the cost of charging such as battery size, cost of electricity, and location of the charging station. Despite these factors influencing the price range of charging, the average cost to fill up a tank of gas is still around 350% more.

Battery size

The first, and constant, charge factor is battery size. The smaller the battery’s kilowatt-hour (kWh) capacity, the less energy it will need to reach a full charge. From there, the battery size, calculated in kWh, is multiplied by the cost of energy which averages $0.10 per kWh in the U.S. You can roughly calculate the cost to charge your EV with this equation: Battery capacity kWh × cost per kWh = charging cost

For example, the battery size for a Tesla Model S is 100kWh so the cost to charge from empty, on average, is $10.

Time of use

The next factor is time-of-use (TOU) where early-bird, peak, and off-peak hours affect pricing. While TOU hours can vary per electricity provider, they typically fall into these timeframes:

Early-bird hours are from 12 a.m. to 8 a.m. and have the lowest cost.

Peak hours are from 4 p.m. to 9 p.m. and have the highest cost.

Off-peak hours are from 8 a.m. to 4 p.m. and 9 p.m. to 12 a.m. and fall in between early-bird and peak hour pricing.

Both demand and energy supply affect pricing in each TOU window. During early-bird hours when demand is the lowest, electricity rates mirror this with the lowest rates. During peak hours when solar energy is decreasing but demand is high, the cost of electricity is the highest. During off-peak hours when solar energy is most plentiful or demand is decreasing, electricity rates are not as costly as with peak hours.

Location: private vs. public stations

Another major factor in charging cost is location. Electric car charging via private stations, like at a fleet depot or at home charging garages, will yield prices closest to the charging cost calculation above. Public charging stations, like those in retail parking lots or commercial charging stations, will have higher average prices with more variability. Some public charging networks, like EVgo, have rolled out monthly subscriptions where members receive better rates than non-members, while other providers charge per minute of use instead of by kWh consumed. The metropolitan area the charging location is in can also affect rates—for example, Los Angeles has some of the most expensive electricity rates in the U.S.

Type of charger

Using DC fast chargers, or superchargers, will be more expensive than level 2 chargers since DC fast chargers require more energy. A common strategy for optimized cost and timing is to charge your EV to 80% with a level 2 charger, followed by a supercharger for the remaining 20%.

What does it costs to install an EV charging station?

EV charging costs can be unpredictable on the road, leading fleets to install their own charging systems and infrastructure. Charger level and quantity are the primary cost variables when purchasing charging stations.

Type of chargers

Level 1: These chargers are used for residential charging and are not suitable for commercial fleets as they are slow and can overload circuits.

Level 2: The cost of installation ranges from $1,200 to $6,000 per charger. Level 2 chargers are suitable for light-duty trucks and passenger vehicles in a fleet.

Level 3 (DCFC): The cost of installation ranges from $30,000 to $80,000 per charger. Level 3 chargers are required for medium- and heavy-duty fleet vehicles.

Number of chargers

Most level 2 chargers will complete a charge in about six hours—one charger per vehicle is often recommended for fleet depots that house light-duty EVs overnight. The recommended number of DC fast chargers at fleet depots will vary depending on your EV needs—maybe a few superchargers are needed to charge light-duty vehicles quickly during the day, or maybe your fleet is starting to roll out heavy-duty EVs and requires one DCFC per vehicle.

Charging station rebates and incentives

Similar to purchasing electric vehicles, there are tax credits and rebates available for purchasing charging stations. The current federal tax credit, Alternative Fuel Vehicle Refueling Property Credit, covers up to $30,000 or 30% of installation costs of EV charging stations.

Local government incentives are widely available as well—Charge Ahead Colorado offers grants up to 80% of installation costs for all levels of chargers, while California’s CALeVIP program grants up to $80,000 per commercially installed DCFC. Tax incentives by state can be found on AFDC.

Other cost factors

Solar power: Fleet facilities can install solar panels at their depots to offset or even cover the electricity costs their vehicles consume. There are additional costs to installing solar panels but most providers will assist you with ROI calculations.

Networked vs. non-networked chargers: Networked chargers have built-in software and wifi to provide usage data, diagnose problems, balance peak-time loads, and more, while non-networked chargers are less expensive by only providing electricity without internet capabilities.